Tax Relief Act 2024 Summary Uk – Since our Public sector finances, UK: March 2023 bulletin published on 25 April 2023, we have reduced our estimate of borrowing for the 12 months to March 2023 (financial year ending (FYE) 2023) by £9 . As the 2023/2024 financial year is underway, accountants in the UK are bracing themselves for significant place is crucial to maximize proceeds or minimize tax liabilities. Business Asset Disposal .

Tax Relief Act 2024 Summary Uk

Source : koinly.io

Why Getting a $7,500 EV Tax Credit Will be Easier in 2024 WSJ

Source : www.wsj.com

Countdown for Gift and Estate Tax Exemptions | Charles Schwab

Source : www.schwab.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

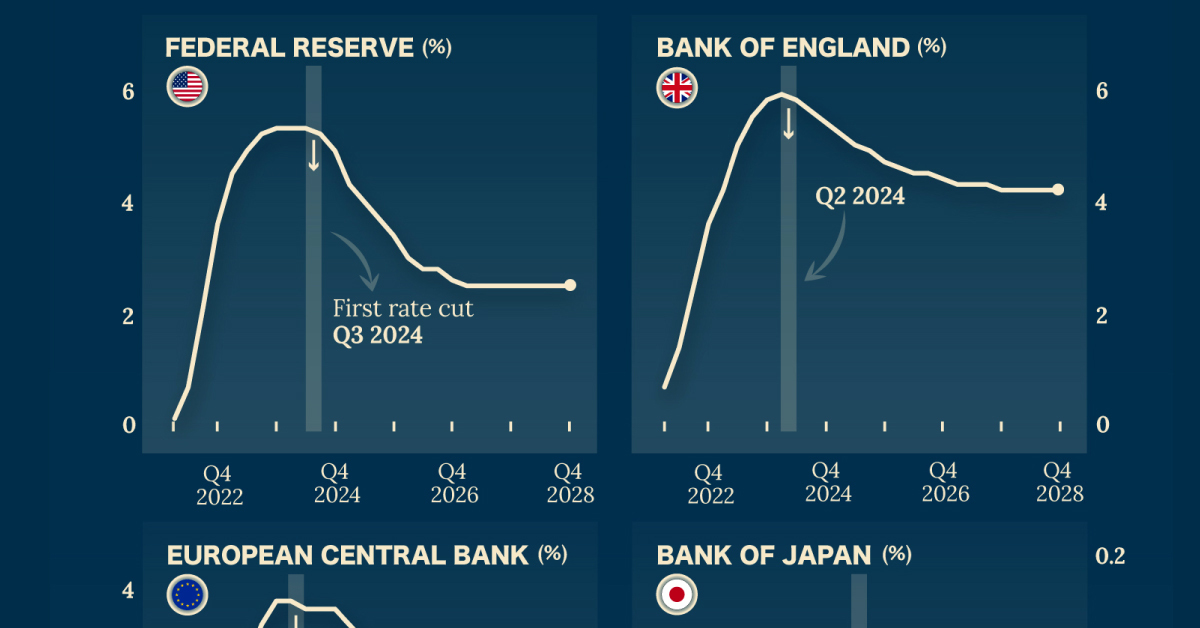

Charted: IMF Forecasts for International Interest Rates

Source : www.visualcapitalist.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

Don’t Miss Out on Your 2023 Tax Breaks WSJ

Source : www.wsj.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Lawmakers announce bipartisan effort to enhance child tax credit

Source : www.westernslopenow.com

Tax Relief Act 2024 Summary Uk Crypto Tax UK: Expert Guide 2024 | Koinly: HM Revenue and Customs hasn’t charged a single company for failing to prevent tax evasion under the Criminal Finances Act 2017, according to new data. The information came to light on Saturday, . Jason Osborne, called the Consumer Tax Relief Act, would reduce the rates of the two business The Communications Services Tax would be halved from 7% to 3.5% for each month from July 2024 to June .